The U.S. and Ukraine just signed a minerals agreement that’s been in the works for a while now. It’s part geopolitical strategy, part resource grab, and part investment opportunity. There’s a lot packed into this thing, and not all of it’s clear yet. But it’s worth looking at what’s in the deal, who’s lined up to benefit, and what investors might want to watch.

The Deal Itself: Resources for Security

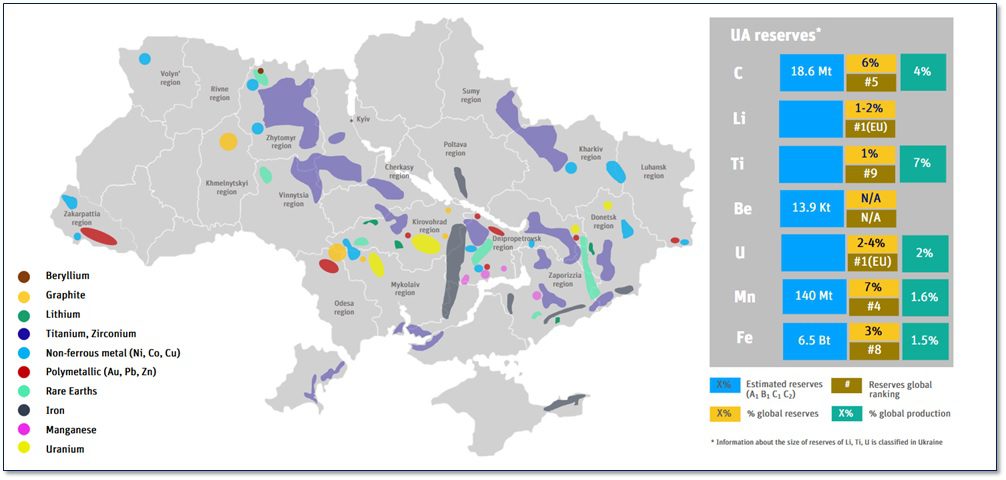

At the core is the United States-Ukraine Reinvestment Fund. The structure gives U.S. entities a path to Ukraine’s rare earths, oil, and gas, so the whole underground catalog. In return, the U.S. commits to continued military and economic support. A kind of trade-off: minerals for stability.

The final terms took a few turns. Back in February, Ukraine pushed back hard when the Trump team floated a $500 billion repayment clause tied to mineral profits. That’s gone now. Kyiv keeps half of the future revenue from state-owned resources. The U.S. gets the “maximum permissible” ownership under American law, so, no full control, but it’s a strong foothold.

Trump pitched it as a smart deal. “We’ll get more than we put in,” he said. Ukraine’s Prime Minister Denys Shmyhal called it an “equal terms” agreement. That might be stretching it a bit. This is still about locking in U.S. leverage while Ukraine keeps the lights on during a war entering its third year.

How the Fund Works

Half of future mineral and oil revenues go into this joint fund. The goal? Reconstruction, mining, energy infrastructure. Ukraine and the U.S. share governance, but let’s be honest, American firms are almost certainly first in line when the contracts roll out.

Rare earths are the obvious headline here. Think smartphones, electric vehicles, military hardware. No one’s officially said which private sector players are getting involved, but you can bet major mining and defense names are already doing their homework.

Ukraine’s Economy Minister, Yulia Svyrydenko, flew to Washington last minute to lock things in. Apparently, there were some tense back-and-forths over transparency. That piece is still a bit fuzzy. The Ukrainian parliament has to approve the deal next, and wartime politics could make that vote unpredictable.

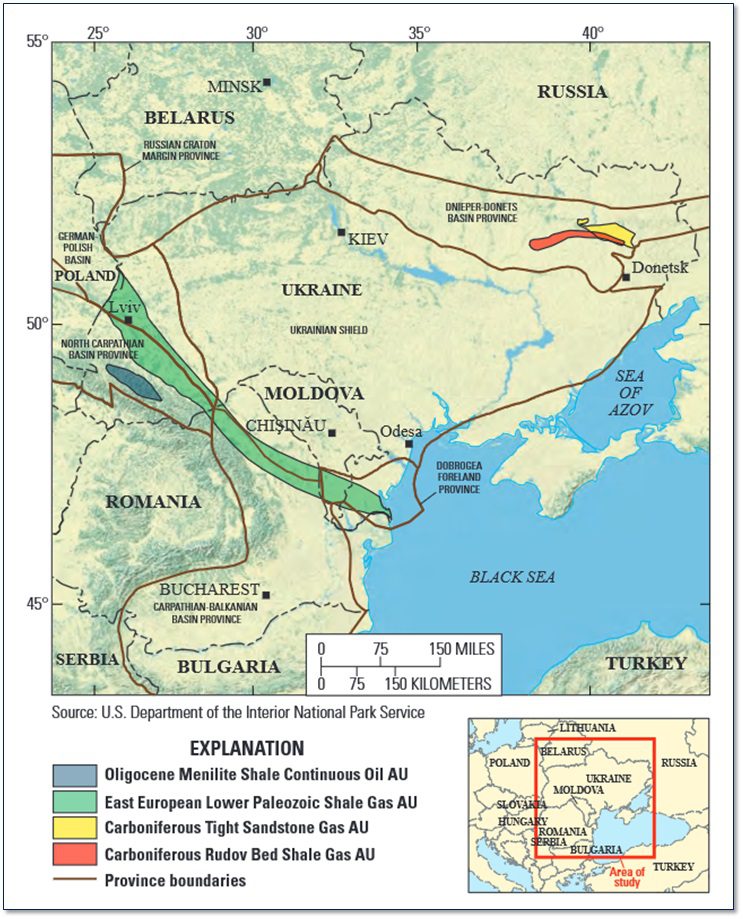

FIGURE 1: Critical Raw Materials Map of Ukraine

The Geopolitical Angle

This isn’t just a resource story. It’s also about how the U.S. plans to stay engaged in the region without ramping up direct military pressure. Trump wants to end the war, or at least say he tried, but this deal gives him a way to show continued support while also securing tangible returns.

He’s had some very public spats with Zelenskyy, especially over Crimea. But this agreement lets him pivot: “prosperous Ukraine” becomes the message now, not “forever war.”

Russia, not surprisingly, hates it. Missile strikes on Kyiv picked up right as negotiations were happening. Whether that’s a message or a coincidence is up for debate, but either way, it underlines how shaky the ground still is.

Why Investors Are Paying Attention

There are three main variables here:

- Security: There’s no hard U.S. military guarantee, but this fund ties American capital, and political reputation, to Ukraine’s survival. That’s not nothing.

- Resources: Ukraine has mineral resources including Europe’s largest known lithium deposits, plus cobalt, nickel, and rare earths. All are mostly untapped because of the war.

- Politics: This is a volatile area. One shift in policy, one change in government, and the whole mining rights structure could be rewritten. Zelenskyy’s team is still vague on the “long-term vision.”

Still, this has caught the eye of global mining firms and defense contractors. Lithium alone is huge for electric vehicle supply chains. Rare earths are essential for a dozen critical tech applications. Companies already operating in Eastern Europe could pivot quickly once it’s safe.

That’s a big if. Transparency is still a problem. One Ukrainian official admitted they’re making “governance tweaks” to appease U.S. anti-corruption requirements. Until that’s squared away, expect slow movement, and heavy due diligence.

The Risk Side of the Ledger

- Parliament – Ukraine’s legislature has killed resource deals before. This one isn’t a lock.

- The War – Frontlines shift constantly. If Russian forces get anywhere near critical resource zones, the whole premise collapses.

- Timing – Even in stable regions, it takes years to bring new mines online. This isn’t a short-term ROI play.

Bottom Line

This deal isn’t just about getting paid back for U.S. aid. It’s a long bet on Ukraine’s ability to rebuild using what’s underground. The U.S. is signaling that it’s willing to back that play, militarily, politically, and financially.

For investors, it’s a high-risk, long-horizon opportunity. There’s no clear map yet, and the flight path could change midair. One U.S. official put it bluntly: “We’re building the plane while flying it.”

Might be a good time to start watching from the runway.

FIGURE 2: Oil and Gas Resources in Geologic Provinces of Ukraine, Romania, and Moldova (North Carpathian Basin Province (Green) and Dnieper-Donets Basin Province (Red & Yellow)