Flutter Entertainment (NYSE: FLUT), a global leader in the gambling industry, is in advanced discussions to acquire Snaitech, the Italian unit of UK-based gambling technology firm Playtech (LSE: PTEC).

The potential transaction, valued at approximately £2 billion ($2.6 billion), highlights Flutter’s ongoing strategy to expand its global footprint through strategic acquisitions.

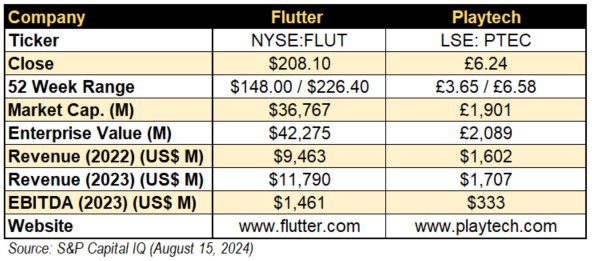

The news has had a notable impact on the market, significantly affecting the share prices of both companies.

Acquisition Talks Between Flutter and Playtech

Flutter is in exclusive talks with Playtech to acquire its Italian subsidiary, Snaitech. This potential acquisition is part of Flutter’s broader strategy to strengthen its position in key markets by expanding through acquisitions.

Snaitech, headquartered in Milan, is one of Italy’s leading betting companies, operating gaming machines, managing horse racing and sports betting, and owning racetracks.

The deal, if finalized, would further solidify Flutter’s presence in the Italian market, where it already owns Sisal, the largest online gambling operator. Both companies have confirmed the discussions but noted that there is no certainty that the transaction will be completed.

Market Impact of the Potential Deal

The announcement of Flutter’s interest in acquiring Snaitech had an impact on the stock market as Playtech’s shares surged as much as 22%, reaching their highest level since March 2022.

This sharp increase reflects investor optimism about the potential deal, which would be one of the largest transactions in the European gambling sector in recent years.

Flutter’s shares also saw a positive bump, rising by 10%. This response underscores the perceived strategic value of the acquisition and the potential for Flutter to further consolidate its position as the world’s largest gambling company.

Strategic Rationale for Flutter’s Expansion

Flutter’s interest in Snaitech is consistent with its broader strategy of international expansion through acquisitions.

CEO Peter Jackson has previously indicated that mergers and acquisitions (M&A) are a key component of the company’s growth strategy, particularly in building “podium positions” in local markets.

The acquisition of Snaitech would provide Flutter with a stronger foothold in Italy, one of Europe’s largest gambling markets.

This move aligns with Flutter’s goal of enhancing its market leadership in Europe while also capitalizing on the growth opportunities in other regions, including the rapidly expanding U.S. market, where Flutter operates the FanDuel brand.

Despite the potential strategic benefits, both Flutter and Playtech have emphasized that there is no certainty that the deal will be completed.

The companies have only confirmed that they are in discussions, with Flutter granted a period of exclusivity to complete due diligence and finalize transaction documentation.

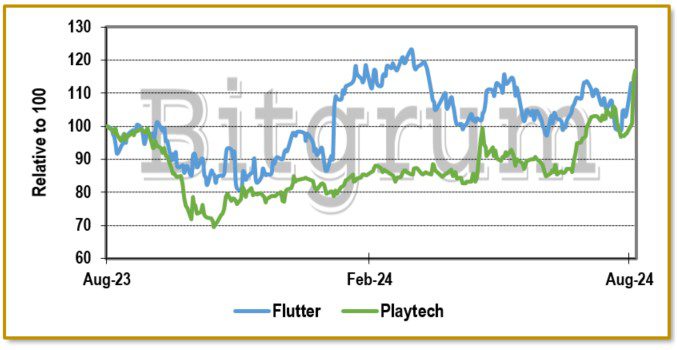

FIGURE 1: Market Data Summary

Broader M&A Activity in the Gambling Sector

The potential acquisition of Snaitech is part of a broader trend of mergers and acquisitions in the gambling industry, particularly among London-listed companies.

In recent years, there has been a wave of consolidation as companies seek to scale their operations, diversify their offerings, and enter new markets.

For instance, Flutter’s interest in Snaitech follows its previous acquisitions of Sisal, Italy’s oldest gaming company, and UK-based online bingo operator Tombola Ltd.

Additionally, Flutter is believed to have made a formal offer for Betnacional, Brazil’s fifth-largest gambling operator. These moves reflect a strategic push by Flutter to expand its global reach and enhance its market position through targeted acquisitions.

About Flutter

Flutter is a leading global operator in the sports betting and iGaming industry, with divisions across the United States, United Kingdom and Ireland, Australia, and various international markets.

The company offers a wide range of products, including sports betting, casino games, daily fantasy sports, and horse racing wagering, primarily through its online platforms.

Key brands under Flutter’s portfolio include FanDuel, Sky Betting & Gaming, Sportsbet, PokerStars, Paddy Power, and Betfair.

With a presence in over 100 markets, Flutter is a prominent player in the sector, continually expanding its reach and innovating to enhance customer experience.

About Playtech

Founded in 1999, Playtech has established itself as a major player in the online gambling industry, particularly in regulated markets. Playtech is a leading provider of business intelligence-driven gambling software, services, content, and platform technology across various product verticals, including casino, live casino, sports betting, virtual sports, bingo, and poker.

The company operates in both B2B and B2C segments, with key brands like Snaitech, Sun Bingo, and HAPPYBET in its portfolio.

Playtech’s unified information management system (IMS) integrates its products across all channels, enabling operators to optimize marketing, enhance cross-selling, and improve player retention.

Final Thoughts

The potential acquisition of Snaitech by Flutter Entertainment represents a significant development in the global gambling industry.

The deal aligns with Flutter’s strategy of expanding its market presence through acquisitions and highlights the ongoing consolidation in the sector.

While the market reaction has been positive, reflecting investor confidence in the strategic value of the transaction, the final outcome remains uncertain.

As Flutter continues to explore international expansion opportunities, this potential deal underscores the company’s commitment to maintaining its leadership position in the global gambling market.

FIGURE 2: 1-Year Relative Stock Chart