The world of cryptocurrencies has never been short of dramatic twists and turns, and the recent events surrounding Bitcoin are a testament to this volatility. In a matter of days, Bitcoin’s price experienced a significant tumble, sending shockwaves throughout the cryptocurrency market.

SpaceX’s Influence?

The calm that had seemingly settled over the crypto market was shattered as news emerged that Elon Musk’s SpaceX had “written down” its Bitcoin holdings or perhaps even sold some or all.

These rumours set off a chain reaction, prompting a massive selloff in not only Bitcoin but also other major cryptocurrencies like Ethereum and Dogecoin.

While Bitcoin plummeted from nearly $29,000 to a two-month low of $25,314 within a mere 24-hour span, the broader crypto market also felt the impact. The trigger, it appears, was the realization that one of the market’s influential players may have divested from the digital asset.

Marketwide Impact

The reverberations were felt beyond the realm of digital currencies. Bitcoin-related stocks, including Coinbase, Marathon Digital, and Riot Platforms, experienced a retreat in their value, highlighting the interconnected nature of the crypto ecosystem.

The news also instigated a wider selloff in digital tokens, with the top 100 digital tokens gauge witnessing a sharp decline of more than 5%. Ether, Cardano, and Solana followed suit, slipping by 2% to 3.2%. These events emphasize the susceptibility of the cryptocurrency market to both internal and external influences.

Cryptocurrency Market Landscape

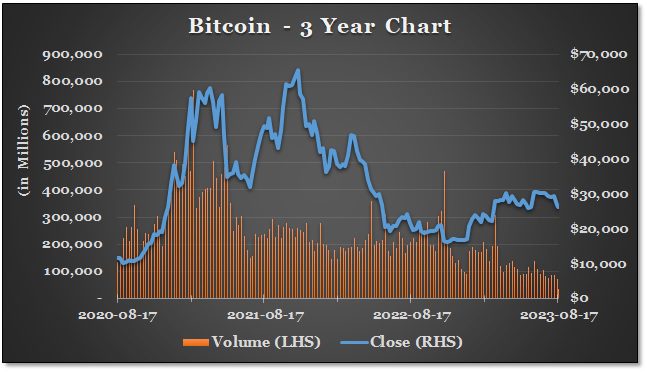

Despite the events, Bitcoin remains notably resilient in its year-to-date performance, boasting a 60% increase since the start of the year. However, headwinds threaten the market’s stability.

Rising bond yields, regulatory pressures, and economic uncertainties in China cast shadows over the appeal of digital assets like cryptocurrencies. The market’s future trajectory appears contingent on how these challenges are addressed and how market sentiment evolves in the face of adversity.

Looking Ahead – Uncertainties but Opportunities

As the cryptocurrency market navigates its way through a period of increased uncertainty, all eyes are on the pivotal $25,000 level for Bitcoin. Should the price dip below this threshold, the options positioning suggests that a cascade of further liquidations could be triggered.

While Bitcoin’s long-term resilience remains evident, short-term challenges and uncertainties have ignited a wave of volatility.

Amid this turmoil, traders are grappling with limited short-term catalysts to drive Bitcoin’s price higher. Some analysts anticipate that if the global risk-off sentiment persists, Bitcoin could face additional downward pressure.

The interconnectedness of cryptocurrencies and traditional markets further complicates the landscape. As the market grapples with these fluctuations, traders and investors must remain vigilant and adaptive, navigating both the opportunities and challenges that lie ahead in this ever-evolving landscape.