ChainLink is a decentralized data oracle network connecting smart contracts to credible, real-world data. To put it simply, ChainLink is a trustworthy middleware between blockchain smart contracts and external data sources.

A decentralized oracle network employs multiple data inputs. This eliminates any single point of failure in smart contracts and increases end-to-end reliability. As a result, high-value smart contracts securely operate in low trust environments.

The success of any blockchain project depends on its utility and the trust of its investors. Ethereum revolutionized the crypto space by introducing smart contracts. Likewise, ChainLink is changing the status quo by lending smart contracts secure access to reliable data outside the blockchain universe. Now you know why ChainLink is trending among investors.

ChainLink (LINK) sprinted to its record high of $19.83 on August 16, 2020, as per the CoinMarketCap charts. However, at the time of this writing, LINK stands at $13.79. Considering its parabolic growth, it’s hard to predict ChainLink’s fate.

Let’s dive deep into ChainLink to determine whether it is here to stay or merely a pop-and-drop project.

What is ChainLink?

ChainLink is a decentralized data oracle network that feeds blockchain smart contracts with trusted off-blockchain data. LINK is the native cryptocurrency fueling the ChainLink platform.

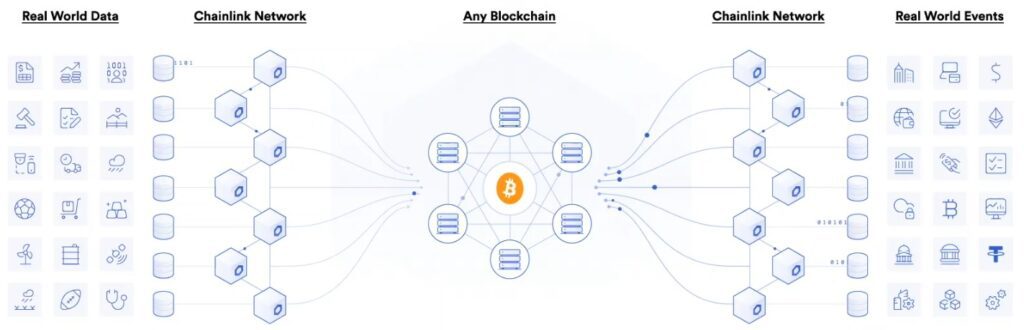

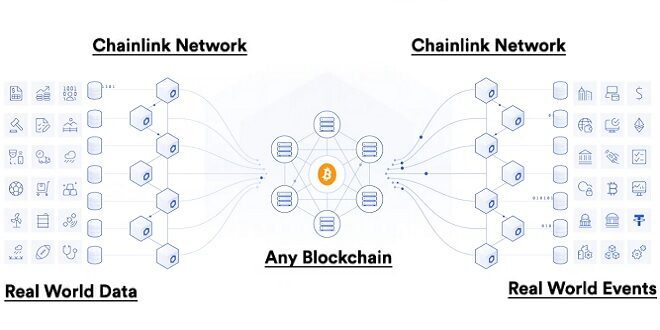

ChainLink data oracle provides external data such as weather reports, sporting event scores, price feeds, location data, etc. These external inputs help smart contracts to execute its predefined operations. For instance, external price feeds power DeFi (Decentralized Finance) smart contracts. Moreover, ChainLink’s data oracle network is tethered to the Ethereum blockchain.

How ChainLink Works?

ChainLink is based on the Request-Event-Response mechanism.

Suppose you deployed a smart contract that requests price feeds from the ChainLink network. This request triggers an event prompting the ChainLink algorithm to select data providers. Data providers aggregate information from real-world sources. In the next step, the data gets verified by ChainLink’s reputation system, and it is then sent to the respective smart contract.

The data providers have to lock specific LINK tokens as deposits. If they deliver false data, they are charged from their deposits. Also, they are incentivized upon successful submissions.

Apart from the incentive-fine mechanism, other facets that guarantee credibility are:

- A large pool of data sources

- Various data providers

- Use of secure hardware

This makes ChainLink one of the most trusted data oracles among industry leaders like Synthetix, SWIFT, Google, and several others.

Should I Invest, Sell or Wait For LINK To Rise?

According to some investors, ChainLink can scale up to $100 – $200 in the present cycle. Moreover, some optimistic investors compare it with Ethereum’s 2017 bull run, aiming as high as $1000.

ChainLink skyrocketed to its new all-time high (ATH) of $19.85 on August 16, 2020. According to a Cointelegraph report, uncertainty among investors signaled them to take profits.

As a result, there were 8.2 million LINK deposits on various exchanges after LINK rose to $15, the highest deposit ever recorded. Santiment reported that despite a dip in its mean dollar invested age, LINK hasn’t slowed down. On August 17, ChainLink’s market capitalization rallied upwards to $6 billion.

Thus, as more and more investors are pocketing profits, LINK is slowly diving downwards. As of this writing, LINK has fallen to $10.41. It has lost its fifth position to Polkadot and has now dwindled to becoming the 8th largest cryptocurrency with a market cap of over $3 billion.

However, new investors like Dave Portnoy will prove as a boost for the LINK token. Also, crypto volatility is common as it is a developing industry.

LINK Rally

So, what was the reason behind this LINK rally?

Factors such as the squeeze short of smart contracts and investors trying to get their hands on YAM tokens contributed to the new highs of the LINK tokens. Moreover, Zeus Capital’s scandal also added to the LINK hype. Zeus Capital allegedly requested crypto Twitter influencers to post negative comments about LINK for a fee.

Other prominent contributors to ChainLink’s meteoric rise include Newsweek coverage and its skyrocketing popularity on Google Trends.

Wrapping Up

As discussed in the introduction, you should make crypto investment decisions based on the project’s utility and its performance in the crypto space. ChainLink has significant utility in the blockchain universe since it is the connecting bridge between smart contracts and the off-blockchain world.

Next Ethereum

So, can we label it as the next Ethereum?

It would be unfair to predict whether or not ChainLink would match Ethereum’s popularity. However, one thing is for sure – ChainLink has the potential to dominate the crypto universe and reach record highs.

FIGURE 1: Chainlink Flow Chart