The AI as a chatbot hype is dead. In cities like London, Berlin, and Paris, a larger transformation is occurring: Autonomous Agents.

In the case of fintech and crypto, it is not just about smarter software. The money is flowing into the Agent-to-Agent economy, where AI can propose a trade, they execute on the owner’s intent. Then pay taxes and even manage processing fees or computational tolls (aka the “gas charges”) across blockchains without a human typing a single word.

The $2 Trillion “Invisible” Market

The AI agent market is currently approximately US$8 billion dollars. It is estimated that it will reach approximately US$50 billion dollars by 2030, contributing to a US$2 trillion AI-driven digital economy.

Crypto provides the trustless financial rails, and AI provides the intelligent decision-making.

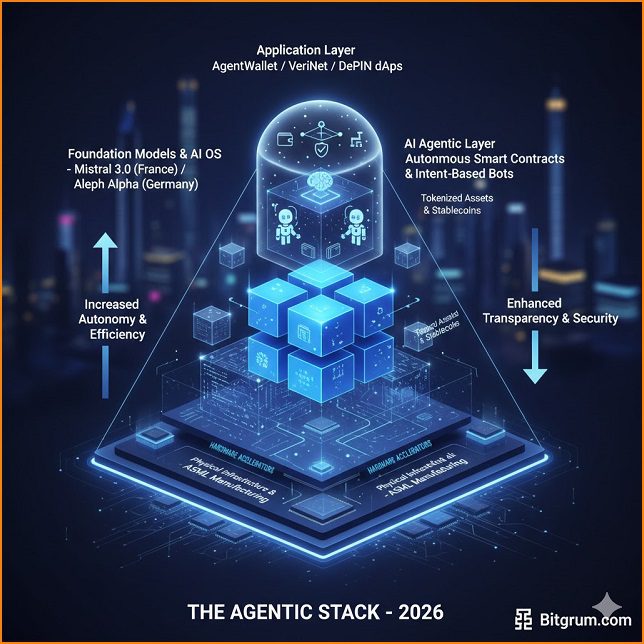

- Agentic Commerce: “Buy for Me” protocols are on the increase in 2026. Visa and other payment companies are experimenting with systems in which AI agents receive tokenized, limited-spend credentials to make purchases to the company and small payments.

- Non-Custodial Intelligence: Startups such as AgentWallet are not just storing money. These Smart Wallets are using predictive data that identifies fraud early and increases returns, serving as a 24/7 digital CFO to your assets.

Deepfakes and the “Truth Layer”

The Blockchain is being utilized as a secure foundation as generative AI makes it more difficult to establish who you are. Firms are applying Ethereum applications such as VeriNet to generate immutable media records.

In the case of fintech, it is not only about preventing fake videos. It’s about identity infrastructure. In a world of deepfakes, the only solution is a blockchain-authenticated digital signature to safely onboard high-value banks and perform Know Your Customer (KYC).

Europe’s Sovereign Advantage

While Silicon Valley builds “Black Box” AI, Europe is doubling down on Sovereign, Ethical Tech.

- Paris: With Mistral AI now valued at €11.7 billion following its landmark partnership with ASML, the French capital has become the epicenter of “Compliance-Native” AI. Its new Mistral 3 family allows agents to operate on local machines, without transmitting data to U.S. clouds.

- London: London connects high finance and agentic systems with over 1,300 AI firms. Conferences such as the FT Future of AI Summit no longer pose the question of whether AI will handle payments, but how we will control the 25% of all transactions in the world that will be made by agents by 2030.

- Berlin: Here, it is about DePIN (Decentralized Physical Infrastructure) and industrial automation. The AI agent interacts with the real world in Berlin, operating energy grids and autonomous supply chains on the blockchain.

The 2026 Outlook: From Co-Pilot to Autopilot

To tech leaders, the message is simple: the new competitive advantage is the Agentic Stack.

When your fintech requires a human to authorize each micro-transaction or manually verify data, you are already slower than an autonomous agent. This year, success depends on delegating authority to the algorithm while maintaining the oversight required by the EU AI Act.