The United Arab Emirates (UAE) is moving rapidly from blockchain experimentation to institutional implementation, making it a major international jurisdiction of tokenized financial infrastructure.

Although regulatory uncertainty is common across international markets, the UAE has put in place a well-organized landscape that is attracting a growing list of international fintech companies and institutional investors.

This change is supported by regulatory frameworks and national policy to modernize capital markets. By 2026, the digital asset ecosystem of the UAE will have become a landscape of regulated exchanges, custodians, and tokenization platforms, backed by over US $2.5 trillion of regional sovereign and quasi-sovereign assets under management.

Regulatory Frameworks Drive Institutional Adoption

The UAE’s growth in the sector is supported by two main regulatory authorities that provide oversight for digital assets:

- Abu Dhabi Global Market (ADGM): Its Financial Services Regulatory Authority (FSRA) has been the first to develop digital asset trading and custody frameworks. At the beginning of 2026, ADGM completed a risk-based stablecoin rulebook that is aimed at meeting the needs of institutions.

- Virtual Asset Regulatory Authority (VARA): VARA is a licensing regime that offers a wide range of services to virtual asset service providers (VASPs) based in Dubai. Recently, the authority has implemented tougher suitability and assessment procedures to boost investor protection and market integrity.

This regulatory transparency has made the UAE a regulatory safe haven for companies that want to move beyond pilot projects.

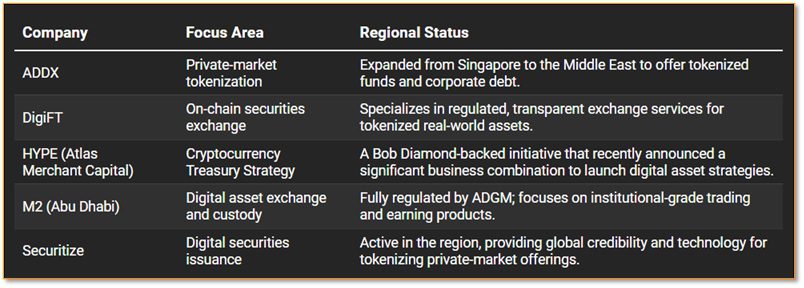

Key Players in the UAE Tokenization Ecosystem

The region’s ambition is reflected in a range of companies establishing operations within its borders. These companies are developing the infrastructure that allows equities, bonds, and other assets in the private market to be issued and traded on blockchain rails.

- ADDX

- ADDX is a Singapore-based major private market tokenization platform that has since spread to the Middle East to provide tokenized funds, bonds, and other assets.

- It fits the ambitions of the UAE because of its institutional partnerships and regulatory alignment.

- Atlas Merchant Capital (HYPE)

- Atlas Merchant Capital is a multinational investment company led by former CEO of Barclays, Bob Diamond, which has just initiated a large-scale cryptocurrency treasury plan.

- The company is using the HYPE token and Hyperliquid protocol to create institutional-grade digital asset reserves through a multi-million dollar business combination.

- DigiFT

- DigiFT is a regulated exchange of on-chain securities specializing in tokenized funds and corporate debt.

- It has expanded operations into the Middle East to take advantage of the regulatory transparency and institutional enthusiasm in the UAE.

- M2

- A fully regulated digital‑asset exchange licensed by ADGM, M2 is building infrastructure for tokenized securities and institutional digital‑asset trading.

- It has attracted senior leadership from global finance and is positioning itself as a compliant, institutional‑first platform.

- Securitize

- Though its headquarters is located in the U.S., Securitize has been more active in the Middle East, collaborating with regional asset managers and considering tokenized offerings of the private market.

- Its presence gives the tokenization ecosystem of the UAE global credibility.

A Strategic Pivot Beyond Oil

The move towards securities based on blockchain is a pillar of the UAE’s broader economic diversification strategy. The government considers this technology to be a crucial economic operating infrastructure, similar to previous underlying changes in finance.

This transition has the following objectives:

- Lowering Costs: Cutting the charges of the conventional issuance and trading.

- Market Efficiency: The introduction of near-instant settlement as an alternative to the existing T+2 day standard.

- Enhanced Access: Enables fractional ownership of high-value assets such as real estate and private equity.

By July 2026, the UAE also plans to roll out the pilot phase of a nationwide electronic invoicing system, which will further digitalize the lifecycle of financial transactions and introduce blockchain-based verification to the rest of the economy.

As the “Great Consolidation” of 2026 progresses, the UAE is likely to remain a preferred destination for firms that prioritize governance-driven models and institutional-grade practices.

TABLE 1: Companies Building the UAE’s Tokenized Securities Ecosystem