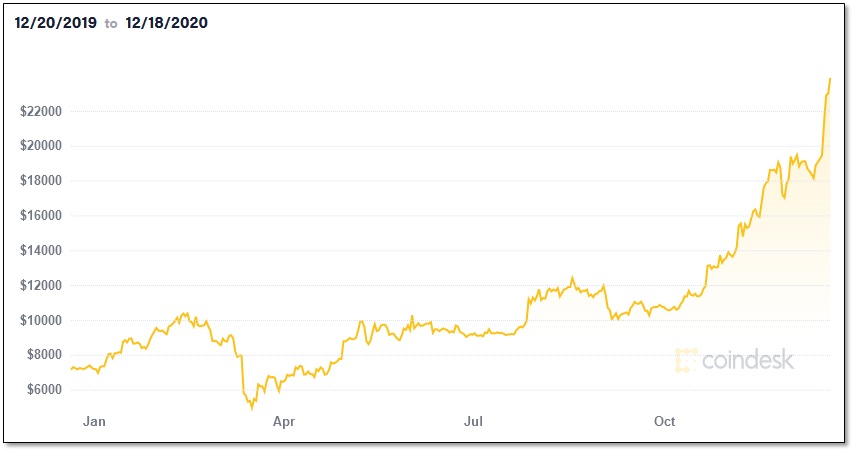

In December, the value of Bitcoin rose to the highest it has been and has increased by almost 250% since January.

Bitcoin has experienced some lows, with some uncertainty around whether it is here to stay or not. However, due to the high liquidity in global markets, Bitcoin has also experienced rises throughout the years.

Factors that Influence the Value of Bitcoin

The major difference between Bitcoin and fiat currencies is that fiat currencies have government support.

Bitcoin is not supported by any specific government and this is reflected in its lack of issuance by any central bank. The plus side is that Bitcoin is not affected by the factors that influence fiat currency.

Bitcoin’s value is influenced by the amount of Bitcoin available and the amount in demand in the market, a number of cryptocurrencies that are competing with it for general recognition, and exchanges that Bitcoin is traded on.

Bitcoin’s Market Supply and Demand

There are several methods used by central banks to influence a fiat currency’s exchange rate. They can influence how much of their currency is in circulation flow by shifting the currency’s discount rate or even being involved in operations in the open markets. These are also methods employed by countries that do not have fixed rates of exchange.

Bitcoins are introduced to the market through digital mining. Digital mining involves the processing of blocks of transactions and is done by Bitcoin miners.

Over time, the speed with which new coins are created is reduced, resulting in higher demand and lesser supply. This limitation would then lead to an increase in value.

The speed by which a new Bitcoin is generated is reduced by reducing the reward offered to Bitcoin miners for processing transaction blocks. This constraint is meant to be a way to artificially create inflation in the cryptocurrency world.

The Number of Cryptocurrencies in Competition for Recognition

Even with Bitcoin’s high popularity, there are a large number amount of cryptocurrencies that are competing for recognition as higher recognition can mean higher value. A higher value can lead to subsequent adoption by the public.

With regards to competition, Ethereum and Litecoin are gaining traction and gaining mind and market share.

Also, it seems to be that new cryptocurrencies are created daily and joining this competition.

However, the high visibility that Bitcoin has, puts it ahead of the rest.

Conclusion

In 5 years, the supply percentage of entities holding less than or equal to 10 Bitcoins increased from 5.1% to 13.8% whereas those entities holding 100 to 100,000 Bitcoins reduced from 62.9% to 49.8%. These results show the increase in the retail investors interested in Bitcoin, and Bitcoin “whales” are decreasing.

After Bitcoin’s value reached past $23,000, it experienced a 250% increase this year and makes it one of the best-performing assets during this period.

The reasons for the remarkable growth in value include the dramatic fall in interest rates and the large size of bond-buying programs. Due to the cryptocurrency’s cap supply, it has been seen as a hedge against inflation, by some investors.

FIGURE 1: Bitcoin Price Chart (1-Year)