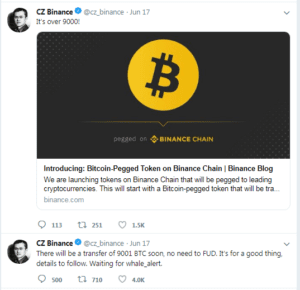

I would like to draw our reader’s attention to the recent announcement published by Binance CEO Chanegpeg Zhao, also known by his initials, CZ. It was regarding the update to its launch of the bitcoin-pegged token to be available on the Binance chain.

I want to briefly give you guys a quick overview of what this actually means so you have a competitive edge over those who are not quite up to scratch on the news.

The Basics

As we all know Binance currently has its own Decentralised exchange (DEX) on which it has built its own blockchain. It’s called the Binance chain and currently only supports tokens built purposely for this chain – meaning users cannot trade any other cryptocurrencies. In order to get around this, Binance has decided to introduce a token assigned on a one-to-one ratio. It wants to incorporate other major cryptocurrencies but has started with Bitcoin.

These crypto-pegged tokens will then be tradable against the Binance chain platform. The crypto exchange plans to issue tokens for many of the coins and tokens listed on its main exchange. Each of these tokens will be backed by reserves held at Binance.

In respect of this Binance will be transferring 9,001 BTC for the launch. That is over $82 Million!

The idea

A working example of such activities is the controversial stablecoin US Dollar pegged Tether coin. In Binance’s case, the reserves will be held in cryptocurrency addresses that can be viewed on block explorers. This provides more transparency, but it still means there is a trusted third party involved.

Binance DEX as had its decentralisation called into question a number of times. Long story short, the DEX is initially quite centralised as it is, relying on node that Binance controls. However, it is non-custodial, meaning users keep control over their own coins.

The reality

Tokens backed by reserves held at Binance isn’t quite the decentralised dream we had all envisaged. For example, let’s say Binance took the reserves and were never to be seen again. The tokens would be become worthless, in essence. Binance users are therefore subject to trusting the exchange – which is something a decentralised exchange should be trying to avoid. Luckily for us Binance did recognise these shortcomings and tried to defend its position by stating that it’s a route way to support other coins.

Good post. I learn something new and challenging on sites I

stumbleupon on a daily basis. It’s always useful to read through articles from other authors and practice a little something from other web sites.