The United States Internal Revenue Service has implemented an effective taxation mechanism on all crypto assets. In essence, every time a person makes a purchase or an exchange using a digital currency, they are exposed to major taxations compared to people who use normal fiat currencies.

Many analysts have argued that this brutal tax regime has been one of the key factors that have hindered the full adoption of cryptos and other digital currencies in the market.

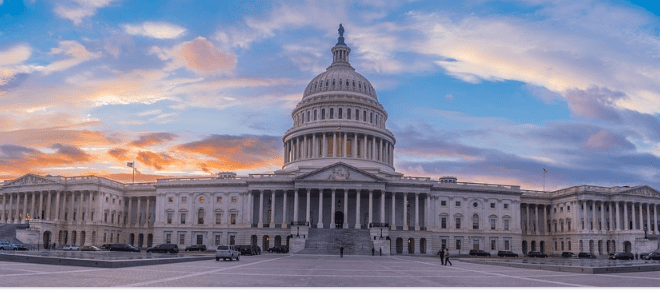

It’s also because of this that many crypto lobbyists have been pushing for more favorable taxation for digital assets. One nonprofit, called the Coin Center, is working with members of the US congress to try and lift these tax barriers.

The Washington–based non-profit is set to introduce a bill in collaboration with lawmakers that would effectively make low–value crypto transactions tax–exempt in the future.

The new bill is, however, still a proposal and it may take a lot of effort and time before it’s passed. But it could play a huge role in lifting barriers of adoption for digital currencies.

Why US Tax Law Has Hindered Bitcoin Adoption

It’s important to first of all note that the Commodity Futures Trading Commission in the United States deems cryptocurrencies as a commodity and property.

What this means is that every time you spend a digital currency, you create a taxable event. It doesn’t matter how small you are spending or how big. Using a digital currency will automatically lead to a tax.

When you consider that most Americans also have other taxes to deal with, it wouldn’t make sense to add another tax burden on cryptos. In its 2014 guidelines relating to digital currencies, IRS explicitly noted that cryptos and other digital assets are to be treated as property.

As a result, they will be liable for taxation if there are any recorded capital gains resulting from the transition of trading of such currencies. This poses two challenges.

First, it means that every single crypto transaction is taxable. Secondly, since the digital currency market is so volatile, price changes can happen any time and they all have to be reported to the IRS. It takes so much time and effort to do this, making cryptos not worth the hassle for a majority of people. But current efforts by the Coin Center could really make things simpler.

The new bill, which has been dubbed the Virtual Currency Tax Fairness Act of 2020, is looking to make low–value crypto transactions easier by adding them to the tax exemption column. The new act has received immediate bi-partisan support, a good sign that it won’t face many congressional hurdles before it’s passed.

In essence, the law, if passed, would mean that individuals will not need to report any crypto transactions with capital gains or losses of less than $200. This new law has been in the works for years now and it could change the crypto landscape significantly in the long term.